What is Investment? Types, Importance, and Where to Invest in the Digital Age

What is Investment? Types, Importance, and Where to Invest in the Digital Age

In the world of wealth creation and financial freedom, one word reigns supreme:

Investment

For entrepreneurs and forward-thinking individuals, investment is the deliberate allocation of capital—be it time, money, or resources—to an asset or venture with the expectation of generating future income or profit. Simply put, it’s about putting your money to work for you.

But as the digital economy evolves, the traditional answers to Where to Invest are changing. This comprehensive guide will break down the core concept of investment, its importance, the key Investment Types, and highlight a modern, high-potential sector: the Cloud Kitchen Investment model offered by The Rolling Plate.

1. What is Investment? The Core Concept

At its heart, investment is an exchange: you trade present money for a potential future return.

It differs significantly from saving. Saving means setting money aside for future use (like in a basic bank account), where its value generally keeps pace with inflation, but offers minimal growth. Investment, conversely, involves risk in exchange for the potential to beat inflation and achieve substantial wealth accumulation.

A successful investment should generate a return that is higher than the rate of inflation over a specific period, thus increasing your actual purchasing power.

2. The Importance of Investment: Why Invest?

Understanding the Importance of Investment is the first step toward financial security and business growth. For B2B investors, the motivations are clear:

- Beating Inflation (The Erosion of Wealth): Money sitting idle loses value over time due to inflation. Strategic investments are essential to ensure your capital grows faster than the cost of living.

- Wealth Creation and Accumulation: Investing allows you to leverage the power of compounding—earning returns on your original investment plus the accumulated earnings from previous periods. This is the bedrock of long-term wealth.

- Achieving Financial Goals: Whether it’s funding a comfortable retirement, expanding your business portfolio, or generating passive income, investments provide the necessary growth engine.

- Building a Diversified Portfolio: By spreading capital across different Investment Types, you mitigate risk and protect your overall financial health from downturns in any single market.

3. Key Investment Types: The Traditional Landscape

The investment world offers a spectrum of choices, each carrying a different risk/return profile. Understanding these Investment Types is crucial for strategic capital allocation:

A. Fixed Income Investments (Low Risk)

- Definition: Investments that provide a regular, fixed return over a specific period.

- Examples: Government Bonds, Fixed Deposits (FDs), Public Provident Fund (PPF).

- Investor Profile: Suitable for those with a low-risk appetite who prioritize capital preservation over high growth.

B. Equity Investments (High Risk)

- Definition: Investing in the stock market by purchasing shares of public companies.

- Examples: Stocks, Equity Mutual Funds.

- Investor Profile: Suitable for long-term investors with a high-risk appetite seeking maximum returns, as equity offers the highest potential for compounding wealth.

C. Real Estate Investments (Medium to High Risk)

- Definition: Buying property (commercial or residential) with the goal of earning rental income or profiting from appreciation.

- Examples: Commercial property, land, REITs (Real Estate Investment Trusts).

- Investor Profile: Attractive for those looking for tangible assets and long-term appreciation, though it requires significant upfront capital.

D. Alternative Investments (Specialized Risk)

- Definition: Assets outside of the traditional categories (stocks, bonds, cash). This is where modern opportunities like the cloud kitchen sector reside.

- Examples: Private Equity, Hedge Funds, Commodity Trading, and Franchise Investments.

- Investor Profile: Appeals to sophisticated investors looking for diversification and exposure to high-growth, niche markets.

4. Where to Invest Now: The Low-Risk, High-Growth Opportunity

While traditional markets remain vital, the digital age has birthed sectors that offer superior growth and lower entry barriers—especially for investors seeking a proven business model.

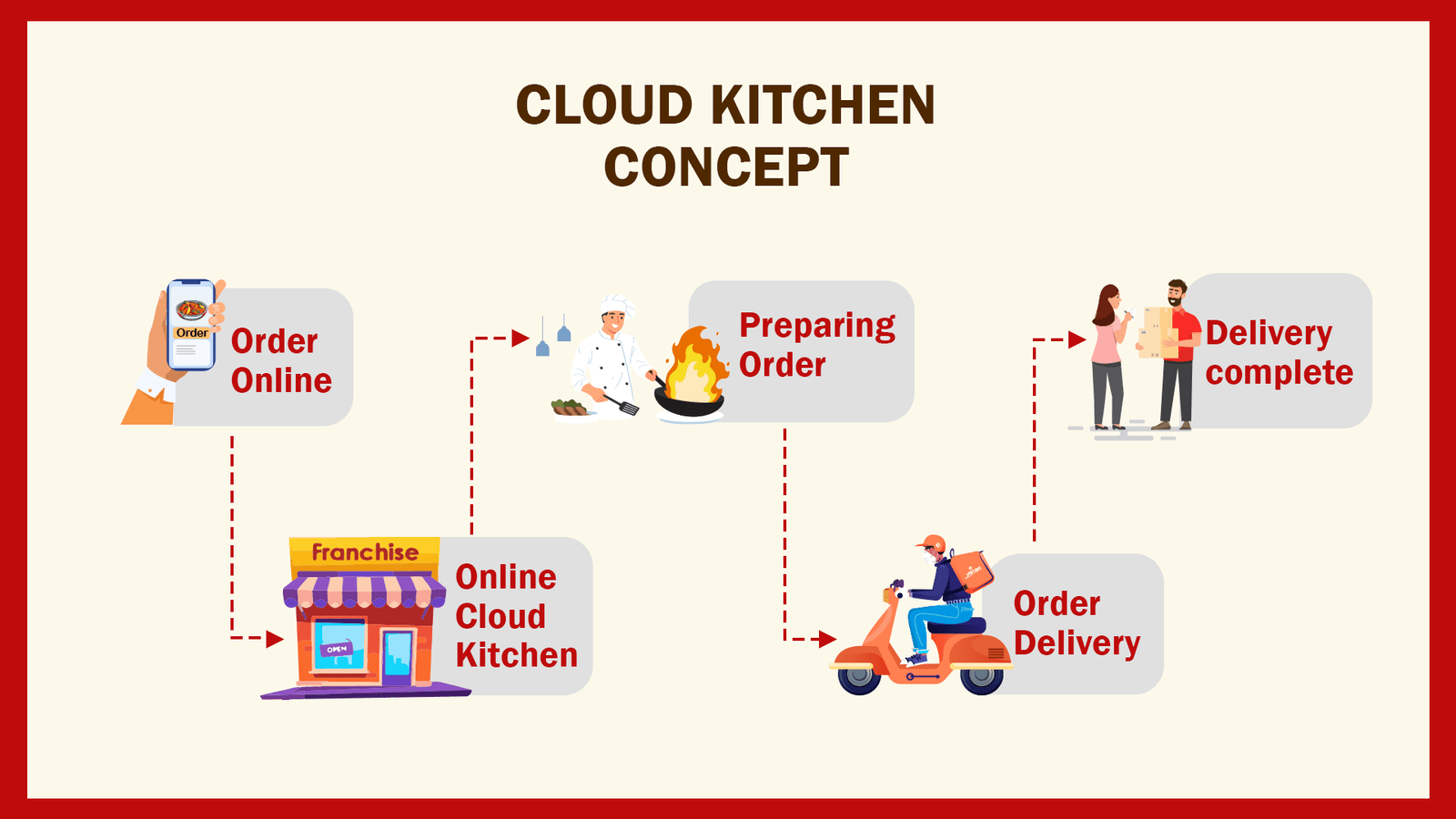

The modern answer to “Where to Invest?” is in scalable, technology-driven franchise concepts like the Cloud Kitchen.

Why Cloud Kitchen Investment is a Smart B2B Choice:

| Feature | Cloud Kitchen Franchise (The Rolling Plate Model) | Traditional Restaurant Investment |

|---|---|---|

| Initial Capital | Significantly Lower (No dine-in infrastructure) | Very High (Requires high-street location, decor) |

| Overhead Costs | Low (Minimal staff, low rent for smaller space) | High (Waitstaff, expensive real estate, utilities) |

| Scalability | High (Easy to launch multiple brands/units digitally) | Limited (Slow, expensive physical expansion) |

| Risk Mitigation | Low-Risk Franchise models (FOFO, FOCO, FOPO) spread risk across multiple brands. | High Risk (Dependent on single physical location and foot traffic) |

The Rolling Plate is uniquely positioned in this high-growth delivery market. We provide a complete, plug-and-play cloud kitchen franchise solution that allows you to start your food business with low investment and minimal risk:

- Multi-Brand Advantage: You invest in a system that operates multiple popular food brands from a single kitchen, maximizing revenue and efficiency.

- Complete Operational Support: We handle everything from branding, standardized recipes, and packaging to crucial online delivery tie-ups (Zomato, Swiggy), staff training, and order management.

- Flexible Investment Types: Our FOFO (Franchise Owned, Franchise Operated), FOCO (Franchise Owned, Company Operated), and FOPO (Franchise Owned, Partner Operated) models allow you to choose the level of involvement and passive income generation you desire.

By investing in a streamlined, tech-enabled cloud kitchen model, you are not just buying a business; you are investing in a proven, high-margin future of the food industry.

Final Thought: Make Your Capital Count

Understanding What is Investment—the calculated risk for future gain—is the first step. The second is choosing the right avenue.

While a balanced portfolio of traditional Investment Types is smart, the greatest returns often come from embracing innovative, high-growth sectors. The Cloud Kitchen Investment model is a prime example of a low-risk franchise opportunity that is perfectly aligned with modern consumer trends.

Ready to diversify your portfolio and tap into the exponential growth of food delivery?

Explore The Rolling Plate’s low-investment, high-return cloud kitchen franchise opportunities today.

Discover our latest news

and updates now.

Top Cloud Kitchen in Ghaziabad You Need to Try Today

February 08, 2026

Exploring the Best Cloud Kitchen in Mumbai: Your Guide to Modern Dining

February 06, 2026

Everything You Should Know About Cloud Kitchen in Noida

February 04, 2026

A Complete Guide to the Best Cloud Kitchen in Bangalore

February 02, 2026

Franchise Investment Opportunities in India: Cost, Profit, and ROI

January 13, 2026